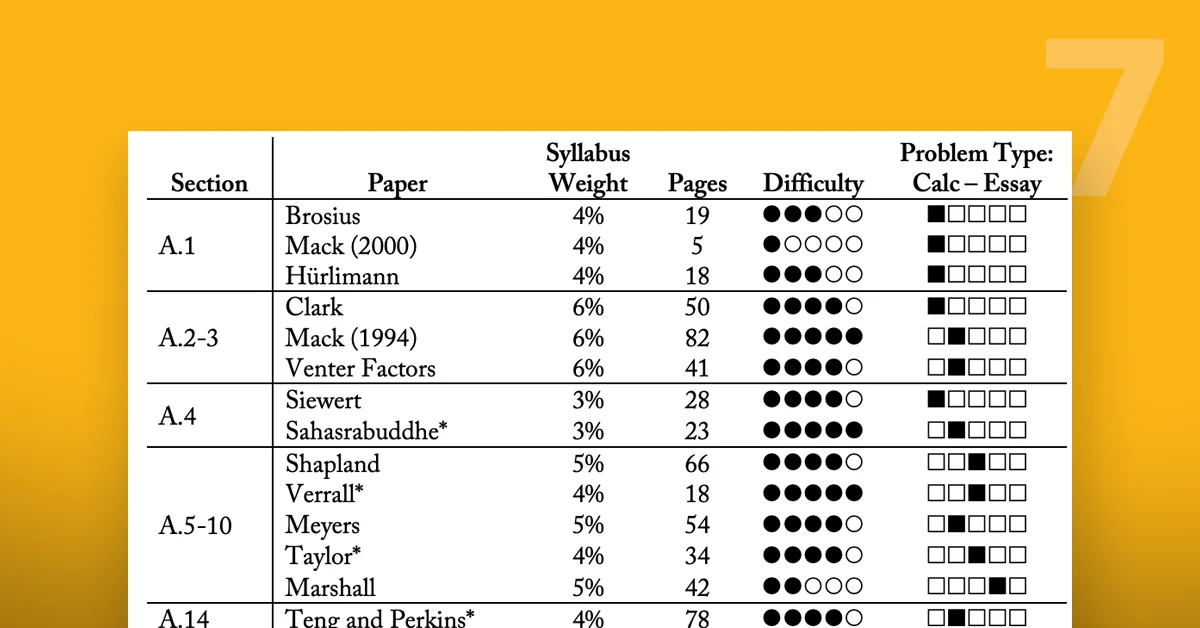

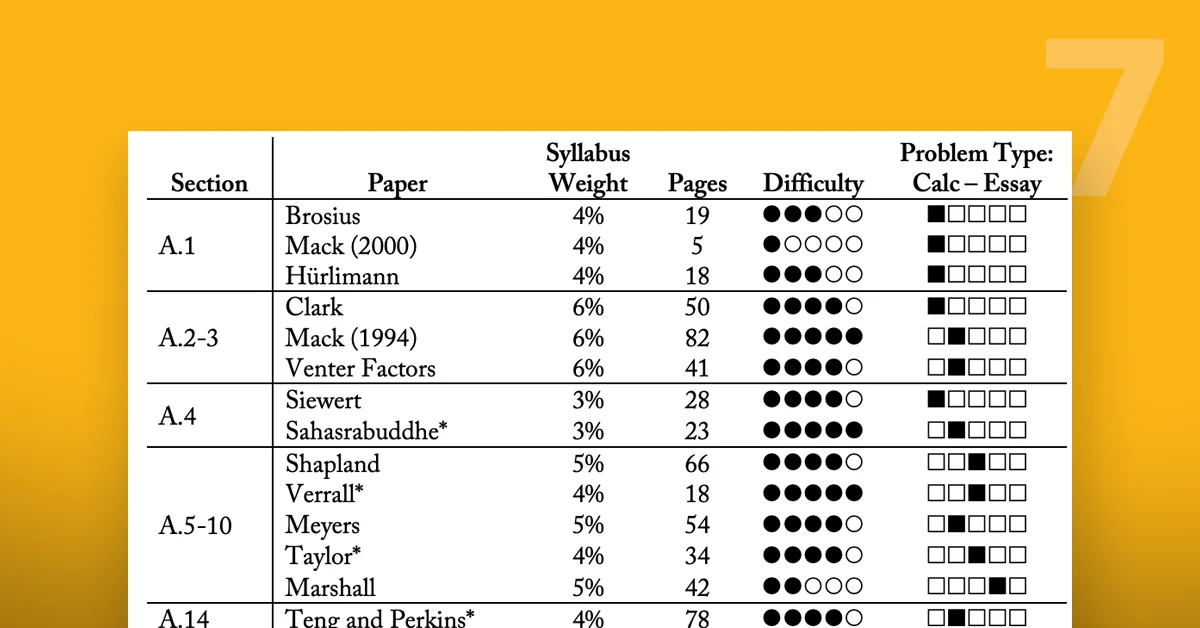

Syllabus Reading List – Exam 7

PDF reading list of the syllabus papers for Exam 7. […]

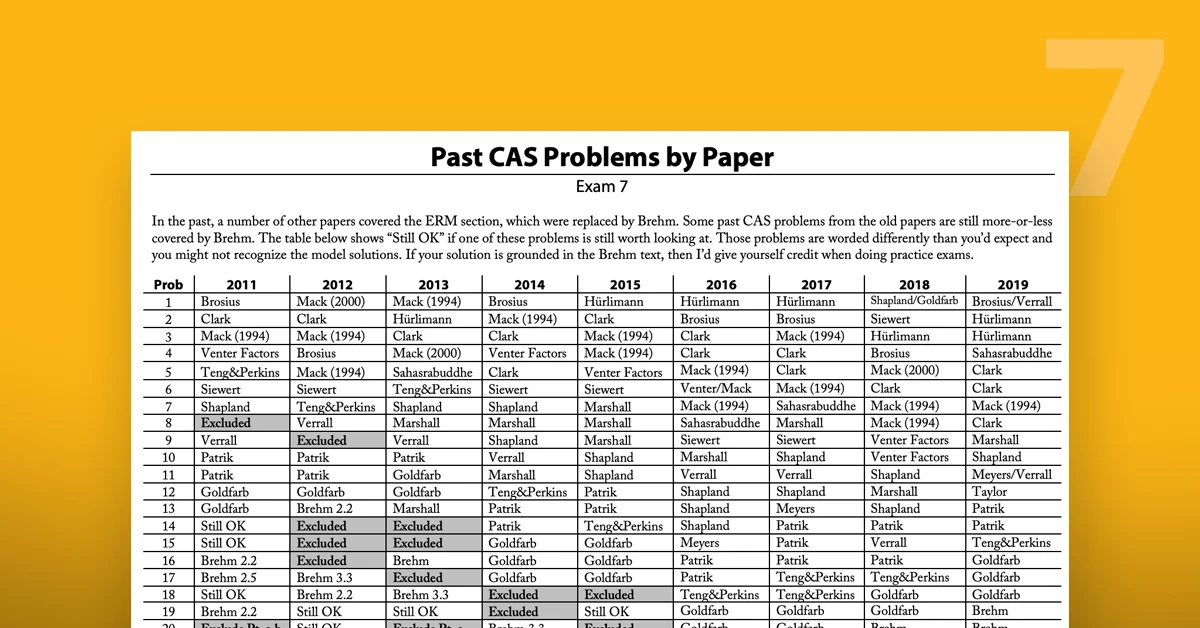

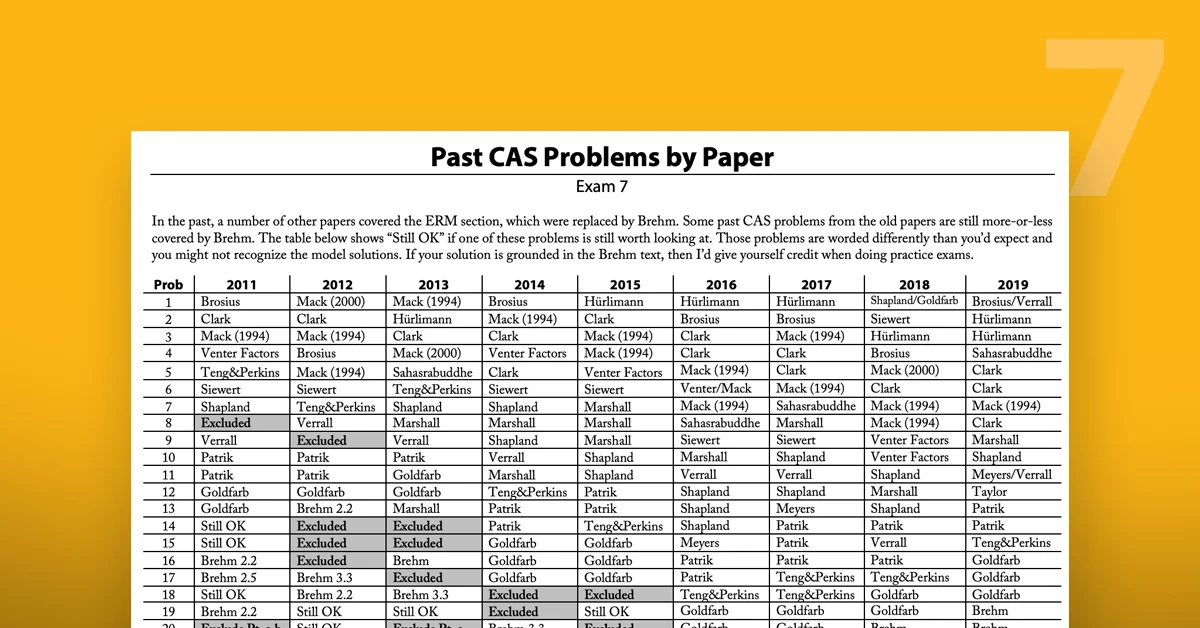

CAS Exam 7 Past Exams

List of the 2011-2019 Past CAS problems by paper for Exam 7. […]

PDF reading list of the syllabus papers for Exam 7. […]

List of the 2011-2019 Past CAS problems by paper for Exam 7. […]